Imagine it: You’re on your way out for a night on the town and stop by the ATM to replenish your cash supply. You notice that your card seems to stick or is partially blocked when you insert it into the card slot, but you don’t think much of it and complete the transaction and take

The next morning you check your online banking statement and see that your account is very low, much lower than it should be. There are charges you didn’t make. Chances are your card information was captured by a thief using a “card skimmer” at the ATM

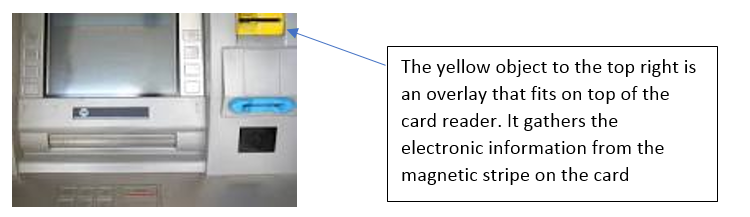

What exactly is a card skimmer? A card skimmer can take one of two forms: One is an overlay that rests on top of the

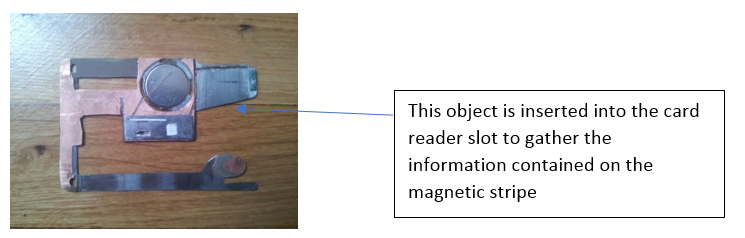

Another type of card skimmer fits into the card reader slot and is more difficult to spot. These same skimmers can also be used at gas station pumps, so be careful

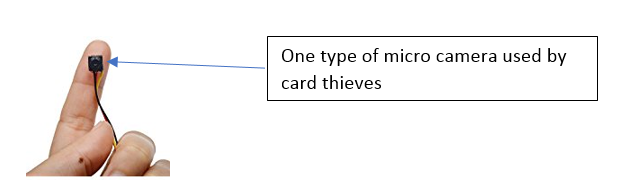

Both devices gather the information contained on the magnetic stripe of the card, and the information is stored on a memory chip. The cyber crooks need to physically retrieve the skimmer to download the data on the memory chip. Additionally, they often use

The combination of the skimmer device and the

It has recently been recorded that some skimmers are coming equipped with

What can we do to protect ourselves from card skimmers? Here are some of

- Inspect the card reader and the area near the

PIN pad. Make sure that everything looks normal and nothing is out of the norm. If it looks or feels funny, don’tuse it. - If the area has multiple ATMs or gas pumps, look at the other to see if they match or are different. If they don’t all look the same consider going to a

different location. - Avoid using your PIN at gas pumps. In most cases the consumer is given the option to use the card as a debit or

credit card. Choose credit and you will not be asked to enter your PIN and the thieves will not be able toobtain it. - Always check your account for

non-authorized activity. - Hide the PIN pad from view with your hand while entering

your PIN.

Now you know what you need to do about skimmers.