Tax identity thieves and IRS imposters are ready for tax season, whether you are or not. Join the Federal Trade

What is tax identity theft? It happens when someone uses your Social Security

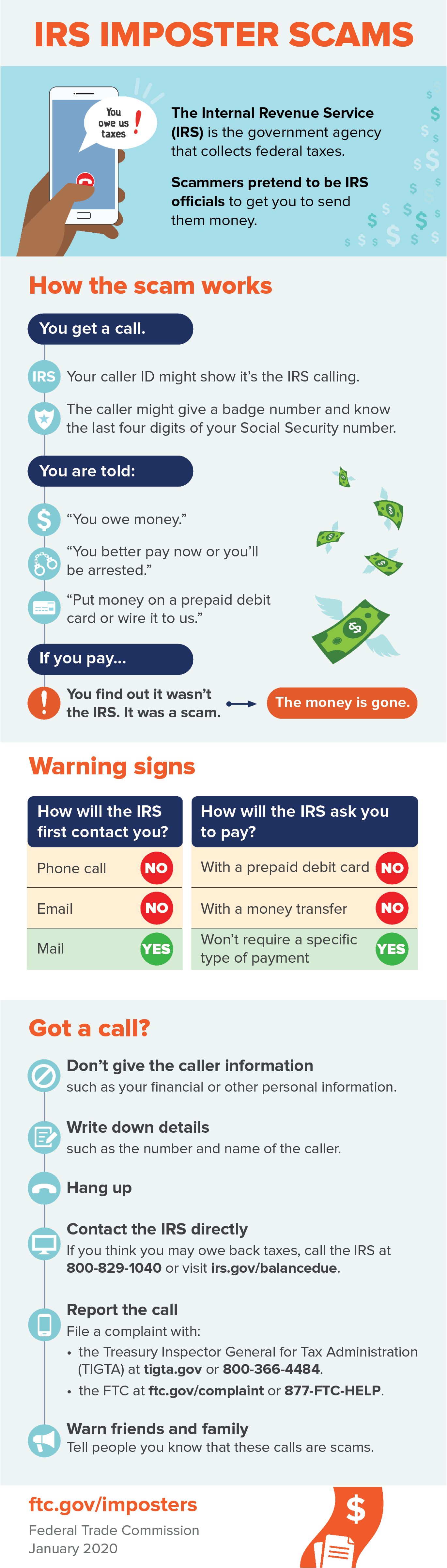

IRS imposters are scammers who pretend they’re calling from the IRS. They claim you owe taxes and demand that you pay right now, usually with a gift card or prepaid debit card. They threaten you’ll be arrested or face other bad consequences if you don’t pay. But it’s all a lie. If you send the money,

Join the FTC and its partners for free webinars and other events during Tax Identity Theft Awareness Week. Learn how to reduce your chance of tax identity theft, the red flag warning signs of IRS imposters, and what to do if fraud happens to you. All of the events will have information for everyone. Some also will highlight special resources for active duty service members, veterans, older adults and small businesses. Ask questions too. Check out the Calendar below to find the event that’s best

To start fighting tax identity theft right

- Protect your SSN throughout the year. Don’t give it out unless there’s a good reason and you’re sure who you’re giving

it to. - File your tax return as early in the tax season as

you can. - Use a secure internet connection if you file electronically, or mail your tax return directly from the

post office. - Research a tax preparer thoroughly before you hand over

personal information. - Check your credit report at least once a year for free at annualcreditreport.com. Make sure no one has opened a new account in

your name.

Check out the FTC’s resources below to

Calendar of Events

Each event is scheduled for an hour unless otherwise stated. Click the links to learn how

Wednesday, January 29, 12 p.m. CT

The FTC, Veterans

Monday, February 3, 1 p.m. CT

The first of two

Tuesday, February 4, 1 p.m. CT

Protecting Sensitive Business and Customer Information: Practical Data Security Practices for Your Business. Experts from the FTC and

- Protecting your business, customers, and employees against tax

identity theft - Imposter scams that target

small businesses - Practical cybersecurity

practices, and - Responding to a

data breach

Wednesday, February 5, 9 a.m. CT and 12 p.m. CT

AARP, the FTC and the U.S. Treasury Department hold two telephone Town Hall meetings, at

Thursday, February 6, 1 p.m. CT

The FTC and the Identity Theft Resource Center

Thursday, February 6, 2 p.m. CT

Join experts from the FTC, the Identity Theft Resource Center, and others for an #IDTheftChat on Twitter. They’ll offer tips on protecting yourself from tax identity theft and government imposters. Join the conversation at #IDTheftChat.

Resources

Read the FTC’s article on Tax-Related Identity Theft.

Visit the IRS’s Taxpayer Guide to Identity Theft.

Check out the FTC’s infographic or watch their video to learn about

What if tax identity theft happens to you?

Visit IdentityTheft.gov to report tax identity theft to the IRS and the FTC and get a personal recovery plan. IdentityTheft.gov helps you complete and file an IRS Identity Theft Affidavit