While there is much discussion in the news about

Using a process known as

The problem has grown so severe that many local and federal authorities have formed task forces around the country, with agents from the Postal

With this widespread fraud going on, it may seem impossible to protect yourself. However, there are some strategies you can employ to reduce your chances of falling victim to

- Use envelopes with security tinting – With a normal envelope, scam artists can hold it up to a light and see that it contains a check. Security tinted envelopes have a patterned lining that makes it impossible to see

through them. - Use a gel ink pen – Certain types of ink, such as gel ink, cannot be washed off because they permeate below the surface of the paper. Some brands specifically note on their packaging that they

are non-erasable. - Fill the fields on your checks completely – Do not leave any blank spaces in the Payee and Amount fields. Write using large handwriting and fill any leftover space with X’s so there are no openings for additional writing to

be added. - Mail checks from the Post Office – Bringing your outgoing mail directly to the

Post Office for mailing is the most secure strategy formailing checks. - Keep a detailed record of the checks you write – This gives you something to refer to if you notice a check has been cashed by a different person or for a different amount than you wrote

it for. - Use online bill pay when possible – Reducing the number of checks you write also reduces your exposure to possible fraud. Paying your bills through a secure website has more protections in place than when you send a check through

the mail. - Monitor your bank statements – Your bank statements will include record of your written checks that have been cashed. If you notice that a check you wrote has been deposited for a larger amount than it was written for, report that fraudulent transaction to your bank immediately. There is a

30-day time frame for reporting, so make sure that you do not missthat window. - Purchase Identity Theft Insurance – The best protection is being pro-active. Having insurance in place before you become a victim of fraud means that you will have assistance in resolving any issues, including funds for attorney fees should you need to pursue a lawsuit

for damages.

Businesses can protect themselves from check washing quite readily by using higher technology checks such as those containing three dimensional reflective metallic holograms or checks treated with chemicals that will make the word void appear if the check is attempted to be altered.

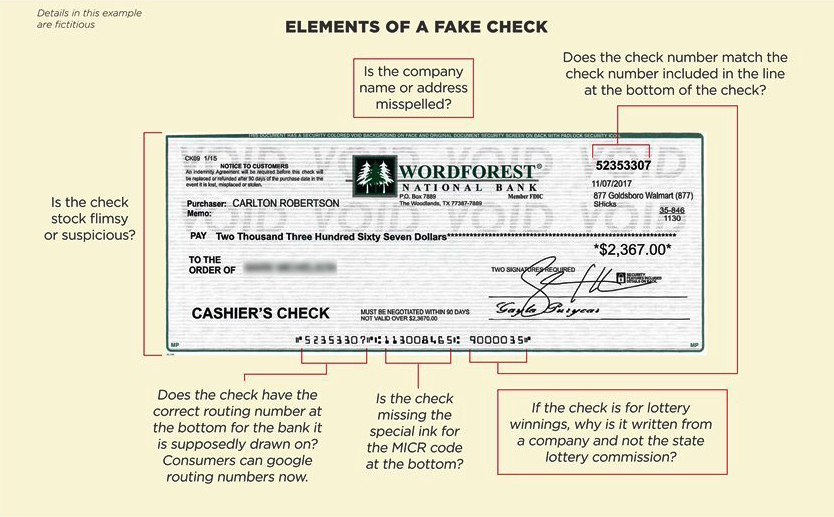

Tips for Detecting Counterfeit Checks

- Color – By fanning through a group of returned checks, a counterfeit may stand out as having a slightly different color than the rest of the checks in

the batch. - Perforation – Most checks produced by a legitimate printer are perforated and have at least one rough edge. However, many companies are now using in-house laser printers with MICR capabilities to generate their own checks from blank stock. These checks may have a micro-perforated edge that is difficult

to detect. - MICR Line Ink – Most, but not all, forgers lack the ability to encode with magnetic ink the bank and customer account information on the bottom of a check. They will often substitute regular toner or ink for magnetic ink, which is dull and

non-reflective. Real magnetic ink applied by laser printers is the exception and may have a shineor gloss. - Routing Numbers – The

nine-digit number between the colon brackets on the bottom of a check is the routing number of the bank on which the check is drawn. The firsttwo digits indicate in which of the12 Federal Reserve Districts the bank is located. It is important that these digits be compared to the location of the bank because a forger will sometimes change the routing number on the check to an incorrect Federal Reserve Bank to buymore time.

If a counterfeit MICR line is printed or altered with